Get Your Score

Monitor Your Score

Arm Your Score

What do you need to do?

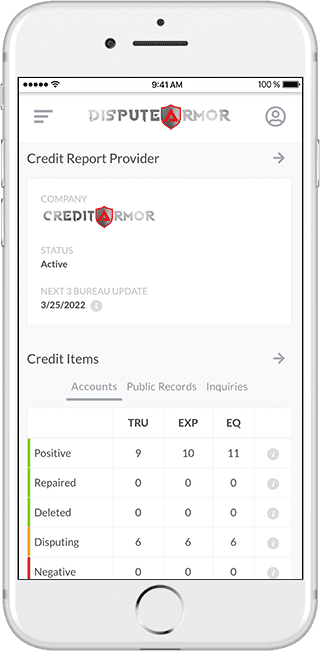

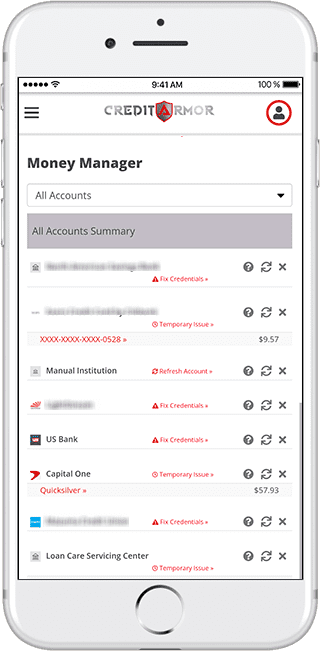

A Smart Credit Report

With Credit Armor’s Smart Credit Report, you get far more than just one credit score. Included with your general credit score, you will also be able to see your Automotive Score, Insurance Score, and your Hiring Index.

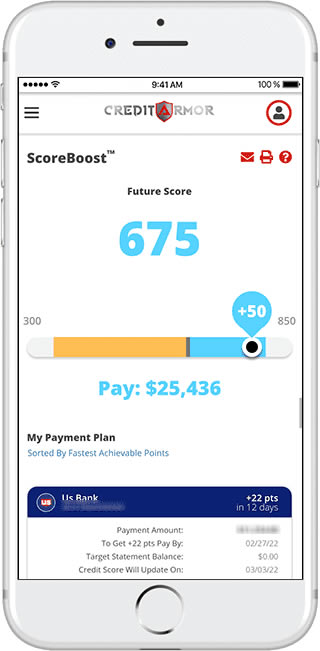

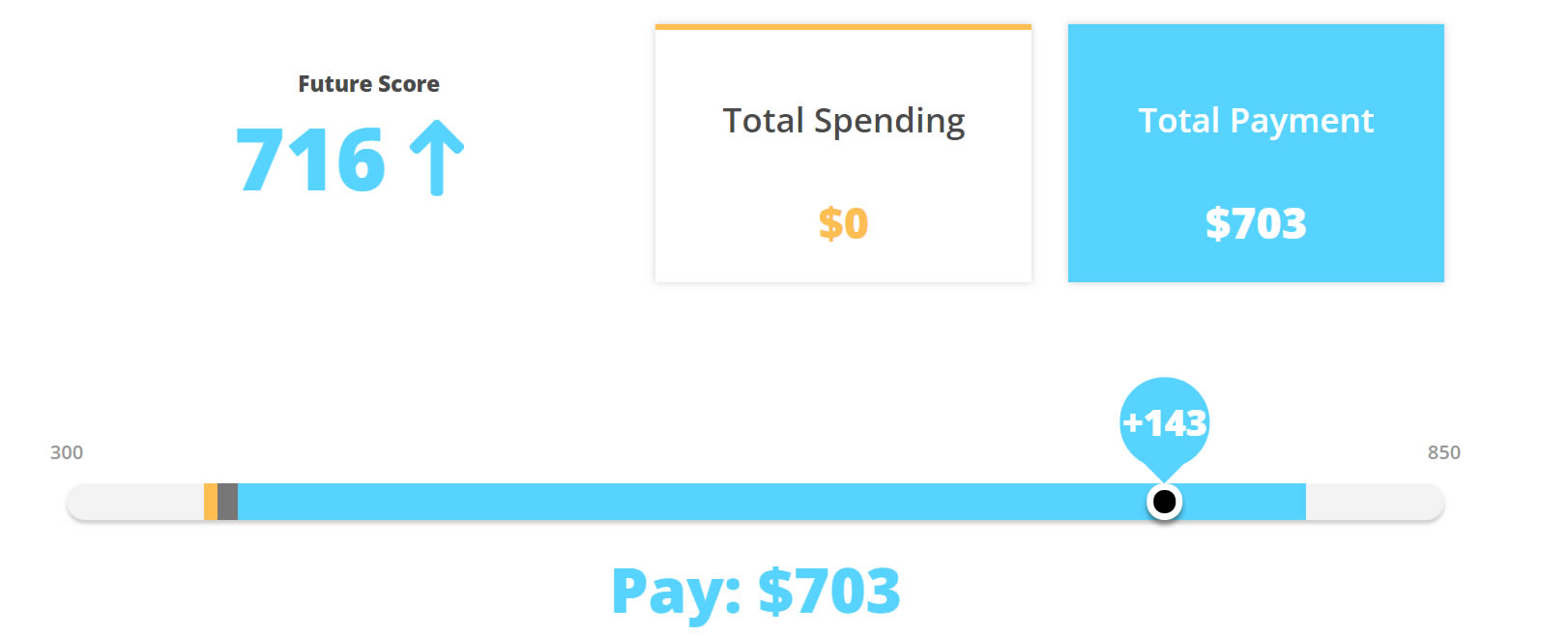

Use Credit Armor’s ScoreBoost® to help you understand how your credit card spending and payments will impact your score.

Smart Credit Report®

A simple and innovative way to view your credit report.

Credit Score

Auto Score

Insurance Score

Hiring Risk Index

Credit Monitoring Alerts

Use Action Buttons

Daily Transactions

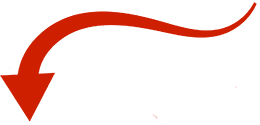

ScoreBoost®

A Personal Plan to Reach Your Target Score Quickly

Take ownership of your credit. Use ScoreBoost® to quickly add points to your credit score before you apply for credit.

How It Works

- Get a personal plan to raise your score based on your target score and points available.

- See how your credit card payments can add points to your credit score.

- Know when and how much to pay on your credit cards to gain the points you need.

- Know when to apply for a credit card, auto loan, mortgage, or other credit.

- Balance spending between accounts to maintain and maximize your credit score.

Our ScoreBoost® is so easy to use! Just move the button to see what paying down your credit card or spending with your credit cards will do to your score.

Fix your own credit like an expert with

Smart Connection

Brilliant Artificial Intelligence

Unlimited Disputes

View Your Dispute Results

Protection

Privacy, Alerts & Fraud Insurance

With all of our products, you get maximum protection.

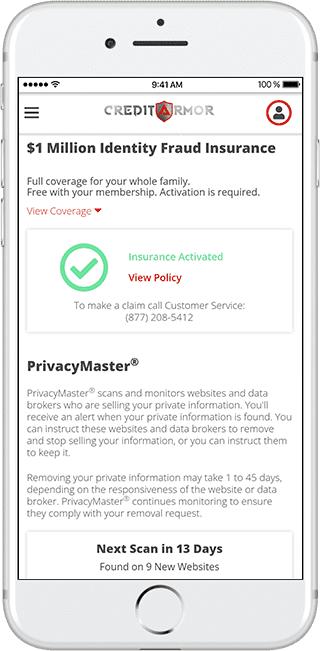

Is your data being used or sold on the web? Our PrivacyMaster® feature scans websites & data brokers for your personal information. Use the action button in your Alerts to quickly react to identity theft. Memberships also include $1 Million of whole family Fraud Insurance.

PrivacyMaster® & Alerts

- Instruct websites & data brokers to remove your info from their website.

- Get alerted when your data has been removed and if it reappears again in the future.

- Quickly inform your bank or creditor of an unauthorized transaction.

- Quickly respond to an unauthorized account activated in your name.

- No filling out lengthy police affidavits or forms.

- Avoid a lengthy bank or creditor process..

- No lengthy phone calls or writing letters.

$1 Million Fraud Insurance

- Zero deductible

- Covers your entire family residing in your household

- Covers your bank, savings, brokerage, lines of credit, credit card, and more

- Covers your cash out of pocket expenses incurred in your ID recovery

- Covers your credit reports

- Covers pre-existing identity fraud you didn’t know about

- Replacement cost due to stolen Driver’s License or Passport

24/7 alerts for peace of mind.

Get notified right away of important activity. Then, use the button in your Alerts to stop theft.

It’s so simple! Just push the button to stop theft.

- No filling out lengthy police affidavits or forms.

- No lengthy insurance claims.

- No getting transferred to third-party credit repair firms.

- No phone calls or writing letters.

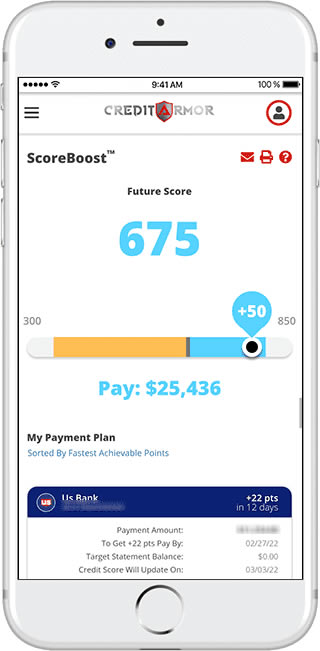

Money Manager®

Manage all your online accounts in one place! With the click of an action button, we connect you with the best!

Know where your money is and where it is going with Money Manager.

Get Your 3 Bureaus Credit Reports & Scores

Membership Plans

Start either plan for only $1 for a 7 day trial!

Protect

-

Unlimited Smart Credit Report & Scores

-

Unlimited ScoreTracker

-

Unlimited ScoreBuilder

-

Unlimited ScoreBoost

-

5 Actions Monthly

-

Unlimited Credit Monitoring

-

Unlimited Money Manager

-

1 Monthly 3-Bureau Report with Scores

-

$1MM ID Fraud Insurance Included with Activation

-

PrivacyMaster®

Build

-

Unlimited Smart Credit Report & Scores

-

Unlimited ScoreTracker

-

Unlimited ScoreBuilder

-

Unlimited ScoreBoost

-

10 Actions Monthly

-

Unlimited Credit Monitoring

-

Unlimited Money Manager

-

2 Monthly 3-Bureau Reports with Scores

-

$1MM ID Fraud Insurance Included with Activation

-

DisputeArmor AI Software with Unlimited Disputing

Other Helpful Tools Available

Additional Resources For Your Peace of Mind

Money Manager

Smart Credit Report®

Privacy & Fraud Insurance