We’ve Rough Waves Ahead In today’s volatile economic landscape, the stability of mortgage rates can feel as precarious as ever. With recent market fluctuations driving mortgage rates to unprecedented heights, prospective homebuyers are faced with a daunting challenge: securing affordable financing amidst soaring interest rates. In this blog, we’ll explore why maintaining a healthy credit […]

Category Archives: Credit Score

In recent years, the United States has witnessed a subtle yet impactful shift—one that isn’t immediately apparent in headlines or breaking news, but whose consequences reverberate through the economic landscape. The National FICO Score, a numerical representation of an individual’s creditworthiness, has experienced a decline that merits our attention and consideration. The FICO Score, ranging […]

Unmasking the Surge in Credit Report Errors In the increasingly digital world we live in, where financial transactions are conducted with just a few clicks, the accuracy of our credit reports has never been more crucial. Recent times have seen a surge in credit report errors, highlighting the pressing need for individuals to check their […]

In times of economic uncertainty, such as a recession, financial stability becomes a paramount concern for individuals and families. As the economy faces ups and downs, one critical aspect that can significantly impact our financial well-being is our credit score. Building and maintaining good credit during a recession is more important than ever, as it […]

For many people, the idea of medical debts haunting their credit reports can be a source of constant worry. Fortunately, in recent years, there has been a positive change in the financial landscape. The removal of medical debts under $500 from credit reports has been a game-changer, resulting in increased credit scores for countless […]

In these uncertain times, economic challenges have become a shared experience for many. One striking indicator of the financial hardships faced by individuals and businesses alike is the unprecedented surge in loan rejections. As we navigate through these turbulent waters, it’s essential to comprehend the factors contributing to this distressing trend and what we as […]

It is no secret that many of the values our parents held are becoming increasingly more difficult to attain; whether it be building your wealth or buying a house, each goal will have a new set of trials and tribulations. As a first-time home buyer, the home buying process can seem like a daunting experience, […]

In times of economic uncertainty, such as a recession, financial stability becomes a paramount concern for individuals and families. As the economy faces ups and downs, one critical aspect that can significantly impact our financial well-being is our credit score. Building and maintaining good credit during a recession is more important than ever, as it […]

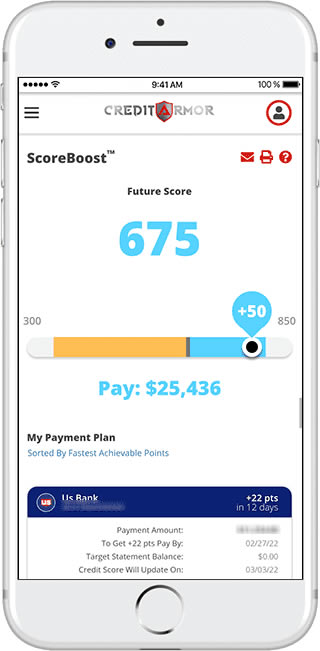

While credit repair can seem like a daunting task for many, Credit Armor allows consumers to quickly and easily dispute items on their credit report, negotiate debts and monitor their scores movement with just the click of a button. In some rare cases, after the disputes have been made and items have been removed from […]

In an era where financial well-being is crucial, credit repair services have gained significant popularity. Lexington Law, a well-known credit repair company, is no stranger to controversy. With a reputation built on promising to help consumers improve their credit scores, they have faced both criticism and accolades over the years. However, recent developments have brought […]