In these uncertain times, economic challenges have become a shared experience for many. One striking indicator of the financial hardships faced by individuals and businesses alike is the unprecedented surge in loan rejections. As we navigate through these turbulent waters, it’s essential to comprehend the factors contributing to this distressing trend and what we as consumers can do to bolster their credit. In todays blog, we will take a look at just what is affecting loan rejections and how Credit Armor’s ScoreBoost tool can help that rejection turn into an acceptance.

How Did We Get Here?

It is important to see just exactly how we got to this point in the first place and take a look at each puzzle piece that fit toget her to create this perfect storm. Loan rejections have reached an all-time high due to a confluence of economic, social, and global factors. Let’s delve into some key reasons behind this alarming phenomenon:

Economic Fallout: The COVID-19 pandemic triggered an economic recession of historic proportions. Business closures, job losses, and financial instability have created a ripple effect, impacting borrowers’ creditworthiness and ability to repay loans.

Tightened Lending Standards: In response to the economic uncertainty, banks and financial institutions have tightened their lending standards. They are scrutinizing applicants more rigorously, making it harder for even creditworthy individuals to secure loans.

Rising Debt Levels: The burden of existing debt has also played a significant role. Many individuals and businesses are already saddled with debt, making lenders wary of extending more credit. High debt-to-income ratios are a common reason for loan rejections.

Uncertain Future: The uncertain economic climate has made it difficult for borrowers to provide lenders with a clear picture of their financial stability and future income prospects. This ambiguity makes lenders more risk-averse.

Credit Score Woes: A deteriorating credit score is a common consequence of financial hardships. Lower credit scores make loan applications more susceptible to rejection or approval with unfavorable terms.

Credit Armors Solution: ScoreBoost

With everthing going on in todays economy, keeping track of your spending habits, credit portfolio and financial capabilities is more pertinant than ever. Below we will look at how Credit Armors ScoreBoost can help!

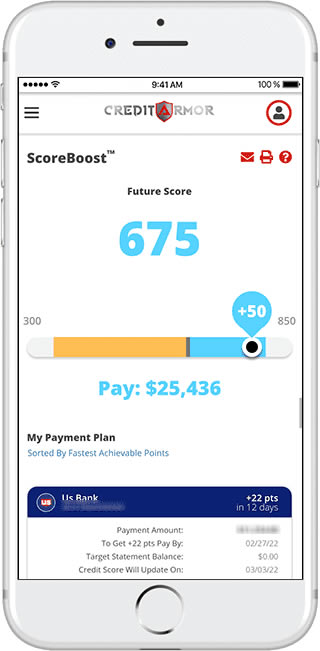

So what exactly is ScoreBoost from Credit Armor? Score Boost is a tool that helps create a personal plan to reach your target score quickly and efficiently. With ScoreBoost, members can take control of their credit to quickly add points to their credit score before applying for a line of credit. With ScoreBoost, you can see your future score before you apply, spend or pay and even get a personal plan based on your target score. With ScoreBoost you can see how your credit card payments can add points to your credit score, know when and how much to pay to help raise your score, balance spending between account to maximize your score and even know when you apply for a new line of credit. If you would like to learn more about ScoreBoost and what Credit Armor has to offer, watch a short video here