In the world of credit repair and debt management, individuals often encounter various methods and strategies to improve their credit scores. One such practice that has generated both interest and controversy is “pay for deletion.” This approach involves negotiating with creditors or collection agencies to remove negative entries from your credit report in exchange for […]

Category Archives: Credit Score

Credit monitoring services are becoming increasingly popular among consumers as a way to protect their credit and identity. One such service is Credit Armor, which provides customers with real-time alerts and credit score updates. In this blog, we will compare Credit Armor to other credit monitoring services to help you decide which one is best […]

It is no secret that many of the values our parents held are becoming increasingly more difficult to attain; whether it be building your wealth or buying a house, each goal will have a new set of trials and tribulations. As a first-time home buyer, the home buying process can seem like a daunting experience, […]

While credit repair can seem like a daunting task for many, Credit Armor allows consumers to quickly and easily dispute items on their credit report, negotiate debts and monitor their scores movement with just the click of a button. In some rare cases, after the disputes have been made and items have been removed from […]

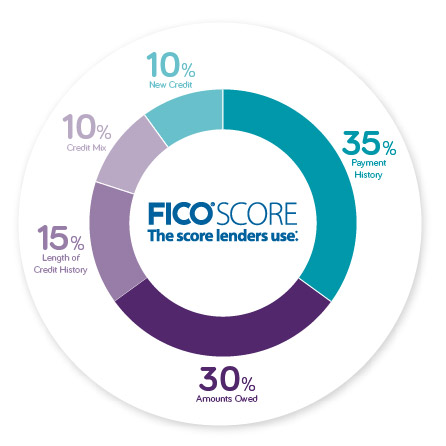

What comes to your mind when you hear the phrase “Credit Mix”. Most consumers imagine the credit pie chart that reveals the impact percentage of their payment history, credit length and utilization rates. Within the pie chart, there are two factors that make up 20% of your grade (new lines of credit and your credit […]

A common misconception that comes with the thought of hard inquiries is that anytime you have your credit pulled, you will receive a small ding you your credit. While there are several ways to pull your credit report, a hard inquiry only occurs when you inquire for a loan or financing with a lender. This […]

Are You Hurting Your Credit? In the world of credit, the option that seems the most logical sometimes is not the best option. When you think about taking out a loan, the first thing that comes to mind is “how quickly can I pay this back?” If that is your mindset, then you are going […]

With the 2022 semester coming to a close and new graduates venturing out on their new journey, Student loans are an ever-present shadow looming over their credit report. In todays blog, we will go over the in’s and out’s of student loans and how they can affect your report in both positive and negative ways. […]

With the 2022 semester coming to a close and new graduates venturing out on their new journey, Student loans are an ever-present shadow looming over their credit report. In todays blog, we will go over the in’s and out’s of student loans and how they can affect your report in both positive and negative ways. […]

Are You Hurting Your Credit? In the world of credit, the option that seems the most logical sometimes is not the best option. When you think about taking out a loan, the first thing that comes to mind is “how quickly can I pay this back?” If that is your mindset, then you are going […]