A common misconception that comes with the thought of hard inquiries is that anytime you have your credit pulled, you will receive a small ding you your credit. While there are several ways to pull your credit report, a hard inquiry only occurs when you inquire for a loan or financing with a lender. This […]

Category Archives: Building Credit

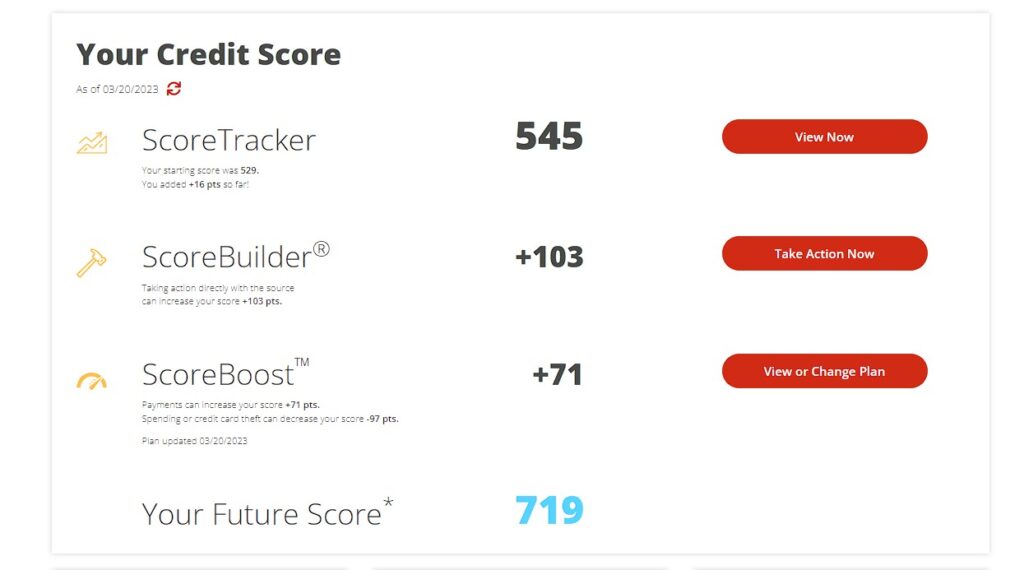

Tools Of The Trade As my lease comes to an end and I think about the headache that is about to come when it comes to searching for another apartment, packing up all my belongings and moving into a new home; I look forward to the day that I can buy my own house. Currently, […]

Your credit report is like a financial fingerprint, reflecting your creditworthiness and financial habits. A healthy credit portfolio is essential for securing loans, mortgages, and even potential job opportunities. Lenders use this report to assess your credit risk, determining whether you are a responsible borrower. To build and maintain a robust credit portfolio, you must […]

Building Up Your FICO When I graduated high school, like many students, I had no idea what a credit score was, how to build my credit or how big of a roll it would play as I progressed in life. Honestly, I thought to myself “If I can’t pay cash for something then and there, […]

Tools Of The Trade As my lease comes to an end and I think about the headache that is about to come when it comes to searching for another apartment, packing up all my belongings and moving into a new home; I look forward to the day that I can buy my own house. Currently, […]

Your credit report is like a financial fingerprint, reflecting your creditworthiness and financial habits. A healthy credit portfolio is essential for securing loans, mortgages, and even potential job opportunities. Lenders use this report to assess your credit risk, determining whether you are a responsible borrower. To build and maintain a robust credit portfolio, you must […]

Hello, my fellow financial enthusiasts! Today, I want to share a game-changing strategy with you that has brought me so much peace of mind when it comes to managing my credit card debt. It’s called the 15/3 Credit Card Payoff Method, and believe me, it’s a game-changer! Now, as we navigate the ups and downs […]

Your credit report is like a financial fingerprint, reflecting your creditworthiness and financial habits. A healthy credit portfolio is essential for securing loans, mortgages, and even potential job opportunities. Lenders use this report to assess your credit risk, determining whether you are a responsible borrower. To build and maintain a robust credit portfolio, you must […]

The In’s and Out’s of Refinancing In today’s blog, we will go over what it means to refinance, how to do it and when you should think about refinancing. Many homeowners refinance for a variety of reasons from combating ever changing rates to saving money on interest rates. What is refinancing? Refinancing happens when you […]

Tools Of The Trade As my lease comes to an end and I think about the headache that is about to come when it comes to searching for another apartment, packing up all my belongings and moving into a new home; I look forward to the day that I can buy my own house. Currently, […]

- 1

- 2