In times of economic uncertainty, safeguarding your financial health becomes paramount. Managing your credit effectively can provide a solid foundation amidst economic turbulence, and tools like Credit Armor can be invaluable allies in this endeavor. 1. Monitor Your Credit Regularly Stay vigilant by regularly checking your credit report. Credit Armor offers continuous monitoring, alerting you […]

Tag Archives: Credit Score

Spring Clean Your Credit with Credit Armor: A Fresh Start for Your Financial Health! Spring is here, and with it comes the urge to declutter your home, refresh your wardrobe, and, of course, give your finances a little TLC. Just like you scrub out those forgotten corners and organize the chaos, it’s the perfect time […]

In today’s financial landscape, maintaining a healthy credit score is crucial for achieving personal financial goals. Whether you’re applying for a mortgage, car loan, or even a credit card, your credit score often determines the interest rates and terms you receive. However, monitoring your credit can be a daunting task, fraught with complexities and potential […]

As the new year begins, many of us set financial resolutions, and improving your credit score is often at the top of the list. A healthy credit score can unlock lower interest rates, better credit card rewards, and opportunities to achieve significant financial milestones like buying a home or starting a business. With tools like […]

Purchasing a car is an exciting milestone in life, but it often requires financial assistance in the form of a car loan. While car loans can provide the necessary funds to buy your dream vehicle, it’s crucial to prepare yourself before diving into the loan application process. By taking some proactive steps, you can secure […]

Start the New Year Strong: The Importance of Getting Your Credit in Order with Credit Armor As the New Year approaches, it’s a perfect time to reflect on your financial goals and take proactive steps toward a more secure future. One of the most impactful resolutions you can make is to prioritize your credit health. […]

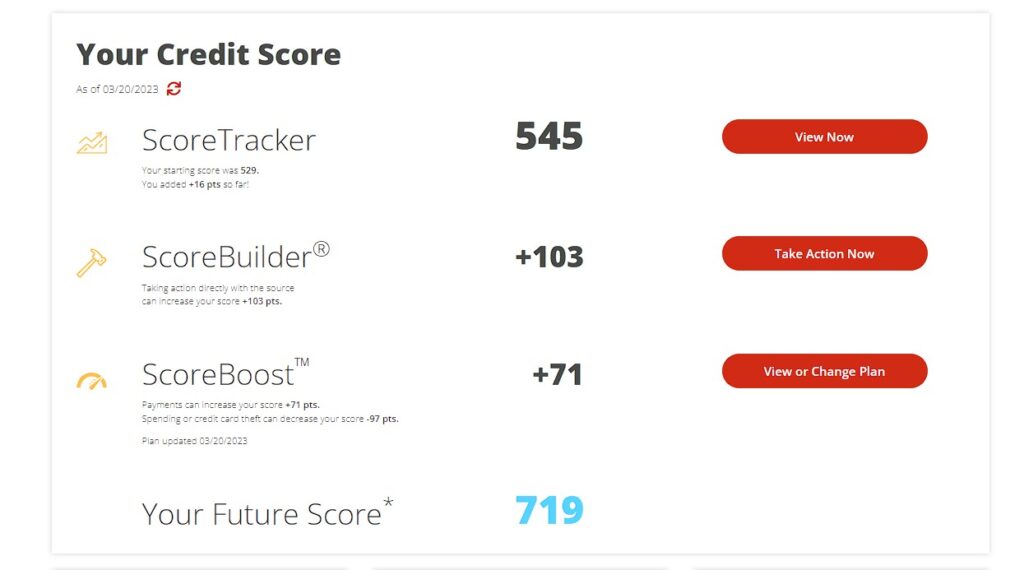

Tools Of The Trade As my lease comes to an end and I think about the headache that is about to come when it comes to searching for another apartment, packing up all my belongings and moving into a new home; I look forward to the day that I can buy my own house. Currently, […]

Purchasing a car is an exciting milestone in life, but it often requires financial assistance in the form of a car loan. While car loans can provide the necessary funds to buy your dream vehicle, it’s crucial to prepare yourself before diving into the loan application process. By taking some proactive steps, you can secure […]

Are You Hurting Your Credit? In the world of credit, the option that seems the most logical sometimes is not the best option. When you think about taking out a loan, the first thing that comes to mind is “how quickly can I pay this back?” If that is your mindset, then you are going […]

We’ve Rough Waves Ahead In today’s volatile economic landscape, the stability of mortgage rates can feel as precarious as ever. With recent market fluctuations driving mortgage rates to unprecedented heights, prospective homebuyers are faced with a daunting challenge: securing affordable financing amidst soaring interest rates. In this blog, we’ll explore why maintaining a healthy credit […]