Have you or a family member been receiving annoying spam calls throughout the day? Has your inbox filled with aggressive collection messages? As a consumer, it is imperative to educate yourself about the process that an actual collection company can attempt to collect a debt as opposed to a scam caller asking you to meet […]

Author Archives: joep

Tools Of The Trade As my lease comes to an end and I think about the headache that is about to come when it comes to searching for another apartment, packing up all my belongings and moving into a new home; I look forward to the day that I can buy my own house. Currently, […]

Purchasing a car is an exciting milestone in life, but it often requires financial assistance in the form of a car loan. While car loans can provide the necessary funds to buy your dream vehicle, it’s crucial to prepare yourself before diving into the loan application process. By taking some proactive steps, you can secure […]

With the 2024 semester coming to a close and new graduates venturing out on their new journey, Student loans are an ever-present shadow looming over their credit report. In todays blog, we will go over the in’s and out’s of student loans and how they can affect your report in both positive and negative ways. […]

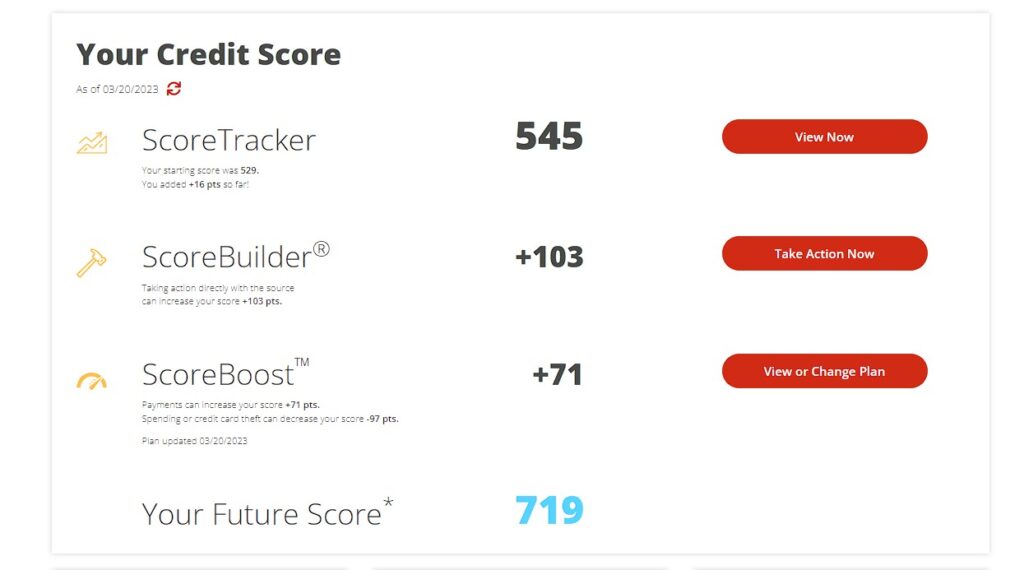

In response to the CFPB’s recent actions against price gouging in credit reporting, finding fair and comprehensive credit solutions is critical for mortgage lenders. Credit Armor offers a competitive edge with its ScoreBoost® feature, which is particularly beneficial in this context. What is ScoreBoost®? ScoreBoost® is a dynamic tool that helps consumers understand and […]

Are You Hurting Your Credit? In the world of credit, the option that seems the most logical sometimes is not the best option. When you think about taking out a loan, the first thing that comes to mind is “how quickly can I pay this back?” If that is your mindset, then you are going […]

We’ve Rough Waves Ahead In today’s volatile economic landscape, the stability of mortgage rates can feel as precarious as ever. With recent market fluctuations driving mortgage rates to unprecedented heights, prospective homebuyers are faced with a daunting challenge: securing affordable financing amidst soaring interest rates. In this blog, we’ll explore why maintaining a healthy credit […]

Your credit report is like a financial fingerprint, reflecting your creditworthiness and financial habits. A healthy credit portfolio is essential for securing loans, mortgages, and even potential job opportunities. Lenders use this report to assess your credit risk, determining whether you are a responsible borrower. To build and maintain a robust credit portfolio, you must […]

In recent years, the United States has witnessed a subtle yet impactful shift—one that isn’t immediately apparent in headlines or breaking news, but whose consequences reverberate through the economic landscape. The National FICO Score, a numerical representation of an individual’s creditworthiness, has experienced a decline that merits our attention and consideration. The FICO Score, ranging […]

Building Up Your FICO When I graduated high school, like many students, I had no idea what a credit score was, how to build my credit or how big of a roll it would play as I progressed in life. Honestly, I thought to myself “If I can’t pay cash for something then and there, […]