In these uncertain times, economic challenges have become a shared experience for many. One striking indicator of the financial hardships faced by individuals and businesses alike is the unprecedented surge in loan rejections. As we navigate through these turbulent waters, it’s essential to comprehend the factors contributing to this distressing trend and what we as […]

Author Archives: joep

Identity theft has been described in many ways over the years through different definitions, but Identity theft refers to when someone steals your personal identifying information for their own personal use. Thieves will use your information to do anything from draining accounts, opening trade lines, creating fake accounts and generally running amok under your name. […]

Here is a wonderful podcast on the implementation of the new VantageScore 4.0 to the Mortgage Industry! The major subject that this podcast explains is the “why” and the benefits of implementing this new score. If you are active in the Mortgage Industry, this a great quick listen athat is less than 15 minutes long. […]

It is no secret that many of the values our parents held are becoming increasingly more difficult to attain; whether it be building your wealth or buying a house, each goal will have a new set of trials and tribulations. As a first-time home buyer, the home buying process can seem like a daunting experience, […]

In an age where personal data is more valuable than ever, incidents of identity theft and credit bureau fraud have become increasingly prevalent. The Federal Trade Commission (FTC) is a governmental body responsible for safeguarding consumers against deceptive practices and fraudulent activities. However, the year 2023 has brought forth a startling revelation: the FTC has […]

Purchasing a car is an exciting milestone in life, but it often requires financial assistance in the form of a car loan. While car loans can provide the necessary funds to buy your dream vehicle, it’s crucial to prepare yourself before diving into the loan application process. By taking some proactive steps, you can secure […]

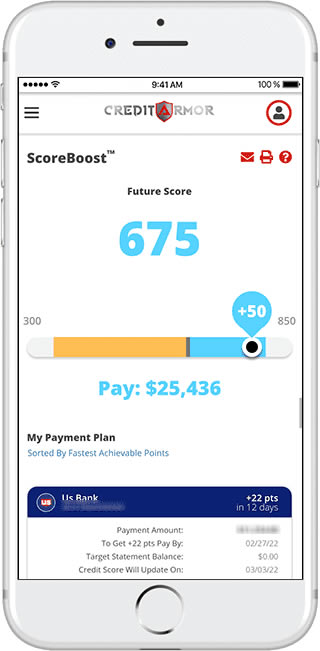

Your credit report is like a financial fingerprint, reflecting your creditworthiness and financial habits. A healthy credit portfolio is essential for securing loans, mortgages, and even potential job opportunities. Lenders use this report to assess your credit risk, determining whether you are a responsible borrower. To build and maintain a robust credit portfolio, you must […]

In today’s fast-paced world, it’s not uncommon for individuals and families to find themselves burdened with debt. Whether it’s due to unexpected medical expenses, student loans, or financial hardships, debt can quickly become overwhelming. However, there is hope. Debt negotiation is a powerful strategy that can help you regain control of your finances and pave […]

When I was younger, I had applied and was accepted by a lender that provided credit cards specifically meant for medical purposes. I was ecstatic knowing that I could finally take care of myself and begin working on some much-needed dental repair. It was a rough process, and I needed my Father to co-sign with […]

In times of economic uncertainty, such as a recession, financial stability becomes a paramount concern for individuals and families. As the economy faces ups and downs, one critical aspect that can significantly impact our financial well-being is our credit score. Building and maintaining good credit during a recession is more important than ever, as it […]